Market Insights

Home Inspection Platforms

1. Industry Overview

Home inspectors perform ~5 million inspections annually in the U.S., with ~30,000 inspection businesses operating.1 On average, inspectors charge $3772.

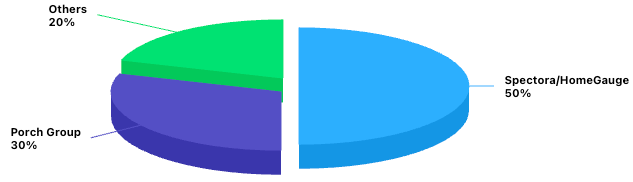

Software Market Share Estimate (2024)

Monthly Pricing Comparison

Feature Strength Comparison

2. Spectora

Overview: Founded 2015 in Denver by Michael & Kevin Wagstaff; cloud‐native, all‐in‐one inspection platform with report writing, scheduling, CRM, websites & more4.

Year Founded

2015

Ownership & Investors

- Bootstrapped until 2024

- Majority stake sold to Radian Capital ($90 M valuation)

- Founders now board members; Peter Osberg, CEO5

M&A History

- Apr 2025: Acquired HomeGauge

- 2024: Exclusive partnership with LaunchPad Home Group (50k+ annual inspections)

Core Features

- Responsive web editor + iOS/Android app

- Automated scheduling, CRM, e-signatures, payments

- Website hosting, SEO services, Spectora Lead Network

- Advanced plan: team management, analytics, QuickBooks integration

Value Proposition

Modern UX, rapid updates, strong community; explicitly does not monetize inspector data.

SWOT Analysis

- Strengths: Intuitive interface; real-time sync; community-driven roadmap

- Weaknesses: $99/mo subscription; limited legacy template depth

- Opportunities: AI for photo recognition & narrative generation; enterprise rollouts

- Threats: Competitor bundling (Porch); cyclical real estate downturns

Technology & Innovation

Cloud-native microservices, weekly releases; exploring ML/NLP for auto-comments and defect detection.

Financials & Projections

- ARR estimated $8–10 M (9,000 × $99/mo)

- Projected ARR $15–20 M by 2028 via upsells & HomeGauge integration

Pricing & Clients

- $99/mo or $999/yr per inspector; $89/mo per additional seat

- Client mix: solo inspectors, small firms, franchises, ~70% US, 30% Canada/intl.

Corporate Structure & Org Chart

~40 employees: Engineering (~20), Client Success (~10), Sales/Marketing (~8), Leadership.

Timeline

- 2015: Founded

- 2017: Public launch

- 2020: COVID growth to ~5,000 users

- 2021: Advanced plan release

- Aug 2024: Radian Capital investment

- Apr 2025: HomeGauge acquisition

Mission Statement

“Build the best software in the industry to empower home inspectors everywhere.”

3. HomeGauge

Overview: Founded 2001 in Asheville, NC by Russell Buchanan. Desktop-centric with cloud report delivery; veteran tool with strong customization and support.

Year Founded

2001

Ownership & M&A

- Nov 2017: Acquired by American Family Insurance (AmFam)

- 2017: Acquired HomeHubZone assets

- Apr 2025: Sold to Spectora (Radian Capital) and integrated into Spectora family

Core Features

- Windows desktop report writer + mobile companion app

- Create Request List™ for repair negotiations

- HomeGauge ONE portal: scheduling, agreements, invoicing

- Website templates & hosting; SEO add-ons

Value Proposition

Deep template customization; trusted by inspectors for 20+ years; dedicated U.S.-based support.

SWOT Analysis

- Strengths: Extensive narrative library; CRL feature; veteran user loyalty

- Weaknesses: Legacy UI; Windows-only desktop; slower dev cycle pre-2025

- Opportunities: Cloud writer via Spectora tech; cross-sell SEO & websites

- Threats: Cloud-only migration; internal overlap with Spectora

Technology Trajectory

Transitioning to cloud via HomeGauge ONE; future: unified web writer, AI-assisted narrative, analytics from historical data.

Financials & Projections

- Pre-acquisition ARR ~$4–5 M (est.)

- 5–10% annual growth forecast; integrated into Spectora ARR post-2025

Pricing & Clients

- $89/mo (annual discount available); legacy one-time $995 license option

- Core: veteran inspectors, franchises, regional roll-ups; ~5,000 active licenses

Corporate Structure

11–50 employees (LinkedIn): support (~10), engineering (~5–8), small sales & marketing, led by President Paul McIntyre.

Timeline

- 2001: Launch

- 2004: Online report delivery

- 2010: Video & CRL

- 2013: Mobile Companion

- Nov 2017: AmFam acquisition

- 2020: HomeGauge Protect warranty

- Apr 2025: Spectora acquisition

Mission & Clients

“Help inspectors deliver professional, reliable reports and grow their business.” ~5,000 active; part of 15,000+ combined Spectora family.

4. Other Competitors

4.1 Home Inspector Pro (HIP)

- Overview: Founded ~2006 by Dominic Maricic; robust desktop + mobile report writer.

- Features:

- Cross-platform desktop & mobile apps

- Customizable templates & narrative libraries

- PDF & online report hosting

- Built-in agreements; integrates with scheduling systems

- Pricing: Subscription ~$74/mo; formerly one-time license ~$699 + maintenance.

- User Base: Large share alongside HomeGauge (~30–40% late 2010s); passionate InterNACHI community

- Competitive Position: Similar to HomeGauge in customization; now part of Porch ecosystem

- Recent Developments: Cloud backup added; integration with Porch’s Repair Pricer & ISN

4.2 Horizon (Carson Dunlop)

- Overview: Launched 2004 by Carson Dunlop (training/education firm); cloud-first with built-in narrative content.

- Features:

- Web-based writer + offline-capable mobile app

- Encyclopedic narrative library & illustrations

- Client/web portal with “Home Reference Book” links

- Basic scheduling & client notifications

- Pricing: Subscription ~$67/mo; free/trial for Carson Dunlop students

- User Base: Strong in Canada; niche U.S. use by those trained at Carson Dunlop

- Competitive Angle: Professional content library; less flexibility but plug-and-play narratives

- Recent Notes: Acquired by Co-operators Feb 2024 for insurance integration; potential bundling with policies6

4.3 Inspection Support Network (ISN)

- Overview: Founded mid-2000s by Dan Huber; cloud-based scheduling/CRM for inspectors.

- Features:

- Online order & calendar management

- Automated emails/SMS for confirmations & follow-ups

- E-signature agreements & payments

- Business analytics & reporting

- Integrations with major report writers

- Pricing: ~$4–5 per inspection; volume discounts; some bundled Porch offerings

- Position in Market: Dominant back-office platform; integrated by competitors; 14,000+ inspectors

- Recent Notes: Under Porch, used to feed homebuyer leads for insurance/warranty upsells; some privacy concerns among inspectors6

4.4 Palm-Tech

- Overview: Late ’90s PDA-origin; simple desktop + mobile data capture.

- Features:

- Checklist-driven mobile app

- Photo insertion & PDF output

- Cloud drive sync

- Basic calendar

- Pricing: One-time license ~$899; now subscription option under Porch

- User Base: Solo inspectors valuing offline speed; few thousand legacy users

- Competition & Trajectory: Niche for low-complexity; under Porch for smaller firms; minimal active development

4.5 3D Inspection System

- Overview: Early ’90s desktop; “Data Driven Documents” focus.

- Features:

- Highly customizable report templates

- 3D Mobile Inspector sync app

- Optional business modules (scheduling, invoicing)

- Pricing: One-time purchase ($300–$1,000 depending on edition); optional annual support

- User Base: Power-users & multi-inspector firms; niche loyal following

- Competitive Position: Ultimate flexibility vs. steeper learning curve; stable independent vendor

4.6 Tap Inspect

- Overview: Launched ~2011; mobile-only design by inspectors for inspectors.

- Features:

- On-site PDF generation on smartphone/tablet

- Signature capture & immediate delivery

- Photo annotation & comment libraries

- Basic scheduling & notifications

- Pricing: Subscription ~$60/mo (unlimited inspections); pay-per-inspection options

- User Base: Solo tech-savvy inspectors; low-volume operators

- Competitive Position: Speed & simplicity over depth; often a stepping stone to more comprehensive platforms

4.7 SnapInspect & zInspector

- Overview: Property management inspection apps repurposed by some home inspectors.

- Features:

- Custom checklist creation

- Photo/video capture

- Cloud report hosting

- Pricing: Tiered by users/properties (SnapInspect ~$99+/mo; zInspector free/basic up to $30+/mo)

- Competitive Position: Generalist apps; not tailored for home purchase but used for ancillary inspections

- Recent Developments: Enhanced dashboards; Zapier integrations; increased rental-inspection focus

4.8 ScribeWare

- Overview: Mid-2010s narrative-centric, desktop + mobile; co-founded by inspector.

- Features:

- Polished report templates & narrative library

- Multi-inspector collaboration in real time

- Photo editor & summary generation

- Pricing: Subscription ~$79/mo including library & cloud backup

- User Base: Niche high-end inspectors; Pacific Northwest stronghold; luxury market appeal

- Competitive Position: Premium report quality vs. modern UX; independent and inspector-led

4.9 EZ Home Inspection Software

- Overview: Budget desktop app by EZ Home Inspection LLC; simple checklist style.

- Features: Basic templates, photo insertion, PDF output; runs on Windows only.

- Pricing: One-time $299; optional $75/yr support; no cloud service included

- User Base: Part-time and price-sensitive inspectors; a few hundred to low thousands

- Competitive Position: Lowest cost entry; limited growth ceiling; minimal updates

4.10 Spectacular Inspection System

- Overview: Early iPad-centric app; mobile-only reporting.

- Features: On-device PDF generation; pre-written narratives; offline capability

- Pricing: One-time $499 or subscription ~$49/mo

- User Base: Tech-savvy iOS inspectors; niche but loyal

- Competitive Position: Pre-Spectora mobile pioneer; UX praised but lacks business tools

4.11 Whisper Reporter

- Overview: 20+ years desktop forms; highly customizable for regulated formats (e.g., Texas TREC).

- Features: WYSIWYG template design; merge reports; module-based for residential/commercial

- Pricing: Perpetual licenses ($200-$600) + optional Ascent cloud subscription

- User Base: Inspectors with specialized/regulatory needs; Texas & niche inspections

- Competitive Position: Ultimate control vs. steep learning curve; independent vendor stability

4.12 Other Notables

- Inspector Nexus: Low-cost mobile app (~$30/mo); modern UX; growing user base11

- InspectIT (AHIT): Training institute-branded Windows app; basic reporting for graduates

- ReportHost: Early cloud pay-per-report model; no subscription; small legacy user base

- Inspector Toolbelt: CRM/scheduling with free basic report writer; targets ISN defectors

- Commercial Tools: Report Form Pro, ProntoForms – used by firms expanding into commercial/HUD inspections

5. Competitive Landscape

The U.S. market is coalescing around two major camps—Spectora/HomeGauge (~50% share) vs. Porch Group (~30%). Independents (~20%) survive via specialization in customization, price, or unique UX.

Market Share Dynamics

Est. Spectora/HomeGauge 50%, Porch portfolio 30%, Others 20%3.

Strategic Approaches

- Spectora/HomeGauge: All-in-one suite, rapid feature cadence, data privacy stance

- Porch Group: Subsidized subscriptions + referral monetization (insurance, repairs, moving)

- Independents: Niche focus—narrative quality, one-time licenses, inspector-led roadmaps

Emerging Trends

- AI: Automatic narratives; image defect detection

- Integrations: Real-estate/insurance APIs; IoT data

- Mobile/Cloud: Reliable offline sync; real-time team collaboration

- Ancillary Services: Warranties; recall checks; lead networks; marketplace offerings

Future leaders will blend continuous innovation, strong community engagement, and transparent monetization to maintain inspector trust and drive growth.

- IBISWorld (ibisworld.com, 2024). U.S. home inspection businesses. Link. Industry research.

- Porch (porch.com, 2019). Home inspection usage & cost survey. Link. Buyer survey data.

- InterNACHI Forum (2019). Market share estimate. Link.

- Spectora (spectora.com, 2025). 9,000+ users. Link. Official metrics.

- Spectora Blog (Apr 1 2025). Acquisition of HomeGauge announcement. Link.

- Porch 10-K (2022). HIP & ISN acquisitions. Link. SEC filing.

- Newswire (Feb 15 2024). Co-operators acquires Carson Dunlop/Horizon. Link.

- GlobeNewswire (Jan 14 2021). Porch acquires Palm-Tech. Link.

- InterNACHI Forum (2019). Spectacular software review. Link.

- Whisper Solutions (whispersolutions.com, 2025). Company history. Link.

- Capterra (2025). Inspector Nexus listing. Link.